A few years ago a distant family member of mine, who lives in Mexico, was called on the phone and told that I was in trouble and I needed money sent right away. Thankfully, she called my mom to checked it out before doing anything else. My mom and I had just talked on the phone and so confirmed I was fine.

Each year, criminals use scams to defraud millions around the world. They use different schemes to trick people into sending them money or into giving out their personal information. When scammers make contact, they often insist money be wired, or they pressure you to make important decisions on the spot.

So here are some tips and resources to help you avoid common scams.

First, send unsolicited email offers or spam to spam@uce.gov.

Check out Your Seller

Before buying online, do a little research first. Is the seller reputable? Do you have a trusted friend who has used the seller before? Try to find out the physical location and phone number of your seller. Do an internet search for the company name and website? Look for negative reviews online. In your favorite search engine, type in the company name with the words, “complaint,” “scam,” “reviews.” Look beyond the first page of results.

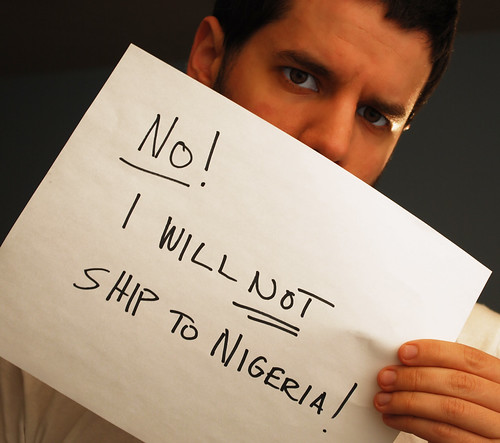

Wiring Money is Like Sending Cash

It's almost impossible to reverse a wire transfer or trace the money once sent. Crooks use all kinds of tricks to pressure, convince, cajole, and persuade folks into sending money via wire transfer. They often claim to be a family member, or friend of a family member, or a friend of a friend in an emergency, as was the case those many years ago when my own relative was called, and they often want to keep the request for money a secret.

Check Your Monthly Statements

I've run into this one, too. Fortunately, my husband decided to catch up on a little paperwork late one night. He checked our bank account and noticed a withdrawal had just been made that he hadn't made himself. It turns out someone used our bank account to pay their electric bill! By the time the bank opened in the morning, we were there reporting the unauthorized withdrawal.

Scammers often steal personal account information so they can run up charges or commit crimes in your name. So look for unusual activity on your bank, credit card, and other statements.

Consider Giving to Established Charities After A Disaster

Have you ever noticed how many new charities pop up after a disaster? Many are well intentioned, but some are not. The problem is big enough that the government has a website specifically for it. Check out ftc.gov/charityfraud for more information.

In addition, consider that even the well intentioned new charity may not have the infrastructure needed to use your money most effectively when the need is critical, often immediately after a disaster..

Here are some further resources where you can read more to help protect yourself with information on different types of frauds and scams:

Phishing: www.consumer.ftc.gov/articles/0003-phishing

Money transfer scams: onguardonline.gov/articles/0007-money-transfer-scams

Online dating scams: onguardonline.gov/articles/0004-online-dating-scams

Work at home scams: onguardonline.gov/articles/0002a-work-home-scams

Weight loss claims: onguardonline.gov/articles/0002b-weight-loss-claims

Fake check scams: onguardonline.gov/articles/0002d-fake-check-scams

Pay in advance credit offers: onguardonline.gov/articles/0002j-pay-advance-credit-offers

Nigerian email scam: www.consumer.ftc.gov/articles/0002l-nigerian-email-scam

Photo Credit: Pic by B Rosen

Disclosure: Thanks to LifeLock for making this post possible. As always my comments and opinions are my own. Mama Latina Tips Information Purposes Legal Disclosure

- Easy Mexican Flan Recipe (Crème Caramel) - February 26, 2024

- Easy Homemade Flour Tortilla Recipe - January 25, 2024

- 50+ Mexican Side Dishes and Drinks to Serve with Tamales - December 8, 2023